The recently legislated tax reform made for an extraordinary end to 2017, when considering how the new tax laws impact you, your family and your finances. Despite an objective to simplify the tax code, it remains complex, particularly the determination of whether you’ll be facing higher or lower taxes in the future.

SageVest Wealth Management outlines the primary changes in individual taxes, focusing on the areas that render the greatest impact to our clients. The majority of tax changes discussed will expire on December 31, 2025, unless otherwise noted.

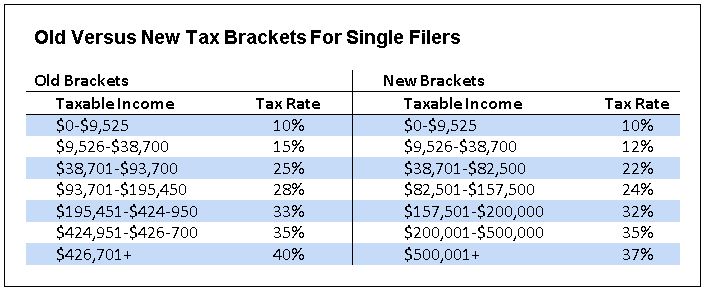

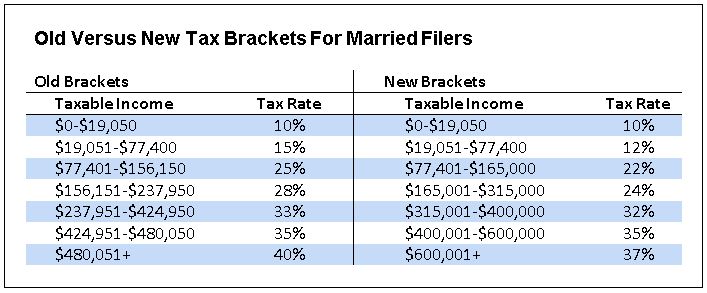

Changes To Individual Income Tax Rates And Brackets

New Individual Tax Rates and Brackets

New lower tax rates go into effect January 1, 2018, potentially bringing tax relief to many individuals. However, while rates are lower, the tax calculation and income brackets are also different. Thus, not everyone will enjoy tax reductions as a result.

Modifications To Individual Alternative Minimum Tax (AMT)

Despite original objectives to abolish it, the Alternative Minimum Tax (AMT) remains, albeit with increases to exemption amounts and phase out thresholds. It’s hoped that AMT will now affect fewer taxpayers as a result.

Changes To Personal Exemptions And Child Tax Credits

Repeal of the Deduction for Personal Exemptions

The repeal of personal exemptions under new tax rules is likely to impact households with multiple family members.

Reform of Child Tax Credit

While personal exemptions have been eliminated, the availability of the Child Tax Credit has increased, due to expanded thresholds. Credits are increased to $2,000 per qualifying child under the age of 17. However, this credit is subject to phase-outs for joint filers with adjusted gross income (AGI) of $110,000 to $400,000, and single filers with AGI of $75,000 to $200,000. As a result, higher income earners will feel the impacts of lost personal exemptions.

Increased Standard Deductions

New tax law dramatically increases the standard deduction to $24,000 for married couples filing a joint return, $18,000 for head-of-household filers, and $12,000 for all other taxpayers. The intention of these higher standard deductions is to minimize tax complexities related to itemized deductions.

Note: Additional standard deductions for the elderly and the blind remain unchanged.

Changes To Itemized Deductions

In exchange for higher standard deductions, several itemized deductions are lost or capped under new tax laws:

Limitation on Deduction for State and Local Taxes (SALT)

Perhaps the most publicly discussed tax reform , and the most impactful to our clients, is the limitation of state and local taxes. Itemized deductions for state and local income taxes, state and local property taxes, and sales taxes, will be limited to $10,000 in the aggregate (not indexed for inflation).

Reductions in Home Mortgage and Home Equity Interest Deductions

The new law grandfathers taxpayers to continue deducting mortgage interest on a total of $1 million of debt for a first and second home. However, new home buyers are limited to deducting mortgage interest only up to $750,000 for a combination of first and second mortgage indebtedness.

The new law also terminates deductions for interest on home-equity indebtedness.

Repeal of Miscellaneous Itemized Deductions

Miscellaneous deductions, including tax preparation fees, investment fees, safe deposit box rental fees, and unreimbursed business expenses are among those eliminated under the new law.

Suspension of overall limitation on itemized deductions (‘Pease’ limitation)

While various itemized deductions are now limited, the good news is the elimination of prior limits to itemized deductions, relative to a taxpayer’s AGI.

Temporary Reduction For Medical Expense Deductions

In a dramatic change from original drafts that outlined full repeal of medical expense deductions, taxpayers will now be allowed to deduct qualified medical expenses in excess of 7.5% of AGI on a temporary basis in tax years 2017 and 2018, with the threshold returning to 10% of AGI in 2019.

Retention of Charitable Deductions

Charitable deductions fortunately remain deductible. However, new higher standard deductions will make it more challenging for some taxpayers to achieve a tax benefit associated with charitable deductions. If your other itemized deductions fall below the new standard deduction threshold, you might benefit from prefunding a charitable gift fund every few years, as this strategy could help maximize your tax deduction potential.

Kids, Education, And Disability Benefit Enhancements

Expansion of 529 Plan Distributions for Elementary or Secondary Schools

An exciting update for parents and grandparents is that 529 plan distributions can now be used to fund elementary and secondary school expenses (up to $10,000 in distributions per student per year). Furthermore, unlike many other tax changes, this provision does not sunset in 2025.

Rollovers Between 529 Plans and Qualified ABLE Programs

Another important change is the new ability to roll amounts penalty-free from qualified tuition programs (Section 529 accounts) into an ABLE account (designed to benefit eligible disabled individuals), where the beneficiary is the same between both accounts, or is a member of the designated beneficiary’s family.

The ‘Kiddie Tax’

Under the previous tax code, a child’s net unearned income was taxed at the higher of the parents’ tax rates or the child’s tax rates. The new law simplifies how the ‘kiddie tax’ is calculated, by effectively applying the ordinary and capital gains rate rates applicable to trusts and estates, rather than requiring a dual calculation.

Roth IRAs

Roth IRA Conversions

It appears that the ‘back-door’ Roth IRA conversion (making a contribution to a non-deductible IRA and later converting it to a Roth IRA) remains viable under the new tax laws.

Roth IRA Recharacterization

Taxpayers could previously convert qualified money to a Roth IRA, yet retain a window of time during which they could change their mind and ‘recharacterize’ some or all of the conversion. This option no longer exists, meaning that any future Roth IRA conversions become committed amounts.

Estate And Gift Tax Changes

Higher Estate And Generation-Skipping Tax Exemptions

The new tax law effectively doubles the estate tax exclusion amount to $10,000,000 per individual (as indexed for inflation for years after 2011). This elevated exclusion applies to estates of decedents, generation-skipping transfers, and gifts completed after 2017. While this change might necessitate estate tax planning changes, any new documents should embed flexibility, as these exclusions are scheduled to expire December 31, 2025.

Tax planning decisions underpin virtually every aspect of your wealth management success. While the breadth and speed of recent tax changes may seem somewhat intimidating, SageVest Wealth Management remains committed to helping you navigate an optimal approach to your taxes and broader finances as the new laws take effect. We invite you to contact us with any questions you may have.