The Class of 2019 is the final graduating class of the best-educated generation in American history: Millennials. Whether you’re a recent graduate or now established in a career, we recommend that you maintain your focus on education – financial education, that is. Now’s the time to sit down and consider how to prepare financially for the opportunities, challenges, and changes that your lifetime may encompass. Following are a number of future financial changes you should plan for.

1) A Longer Lifespan

2019 marks the point at which it’s expected the Millennial generation will surpass Baby Boomers as America’s largest living generation of adults [1]. Thanks to medical advances such as personalized health, you can expect a longer, healthier life, but you’ll need a bigger retirement nest egg to account for this longevity.

Tip: Individualism, experiences, and social responsibility may be high on your list of life values and priorities. Money can be a valuable resource to support these lifestyle goals. Setting short- and long-term financial goals will help you achieve your life and wealth objectives.

2) Changes To Social Security

Longer lifespans, lower birthrates, and government under-funding are all factors in the dwindling Social Security reserves. The latest Social Security Trustees report forecasts that the Old-Age and Survivors Insurance (OASI) Trust Fund, which pays retirement and survivors benefits, will be depleted by 2034 [2]. To address this, a number of future financial changes have been mooted:

- Income tax increases to boost Social Security funds.

- More stringent eligibility for retirement benefit claims.

- Reduced benefit amounts for all claimants.

- Increased taxation of retirement benefits.

While it might seem a long way away, you need to focus on your retirement right now, so you’ll be better prepared for the future.

Tip: Consider funding a Roth IRA or Roth 401(k) once you enter the workforce. Roth IRAs and Roth 401(k)s use after-tax dollars but, unlike traditional IRAs and 401(k)s, withdrawals are tax-free. By paying taxes now, while your taxable income is lower, you’ll avoid taxable withdrawals later in life, when your income will likely be in a higher tax bracket. Like other traditional retirement plans, savings in Roth IRAs and Roth 401(k)s grow tax-free.

3) Continued Advances In Gender Equality

Women have made excellent progress in narrowing the gender gap at home, in the workforce, and across broader society. With time and persistence, gender equality should eventually become a thing of the past. However, without knowing when exactly that’ll happen, there are unique financial considerations you should plan for as a Millennial woman:

- Women continue to earn less than their male counterparts. In 2018, the pay gap remained approximately 20 cents for every dollar earned. [3]

- Despite better academic credentials, women are traditionally over-represented in lower-paid careers such as teaching or social work. Furthermore, almost two thirds of minimum wage earners in the US are women. [4]

- Women are more likely to take a career break to care for children or other family members such as aging parents.

- Women live longer than men.

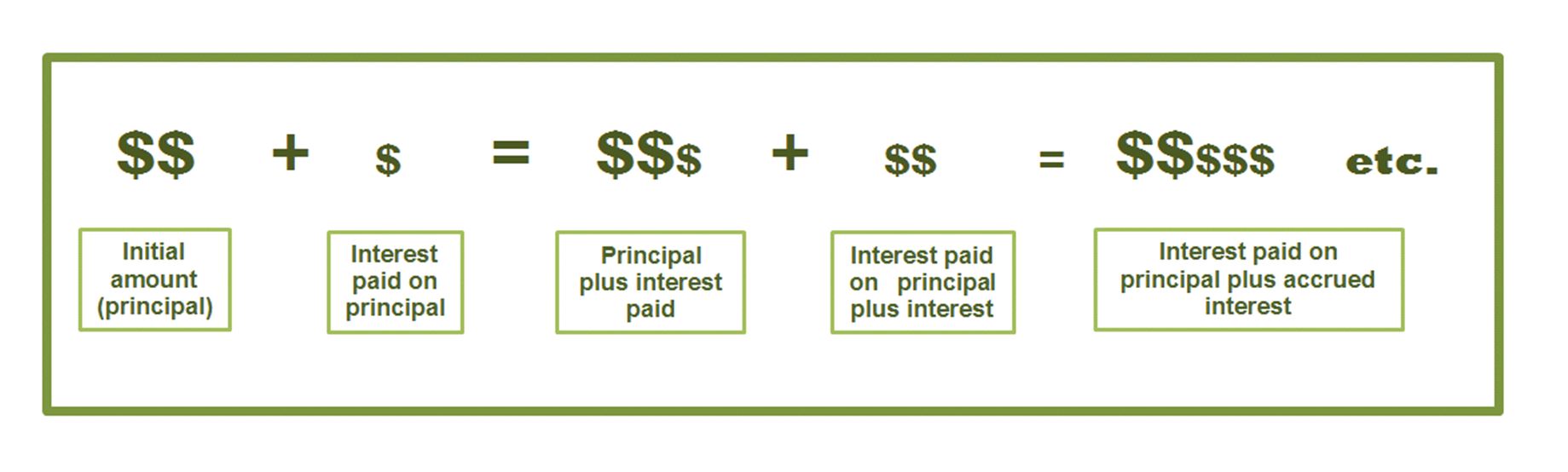

Tip: All these factors can negatively impact every Millennial woman’s opportunity to accrue retirement savings, and affect how long those savings must last. The answer is to start saving as much as you can, as soon as you can. Compound interest is an invaluable strategy, and its effect on long-term savings levels is most startling if you start saving early.

4) A Changing Workforce

There’s currently a sea-change in the American job market. Buoyed by platforms like Uber and Lyft, the freelance or so-called ‘gig’ economy means that around a third of the US workforce is now employed on a 1099 basis. If it continues, that number is expected to near the 50% mark by the mid-2020s.[5] Being self-employed brings with it increased planning needs and opportunities.

Tip: As your own boss, you may be eligible to save for retirement with a solo 401(k) or SEP. These retirement accounts have higher contribution limits. You can contribute up to $56,000 into a solo 401(k) for 2019 (subject to income limits), versus $6,000 (under age 50) into a traditional or Roth IRA. Consult a tax professional for further advice.

5) Improved Technology

Like other technology, advances in financial technology will no doubt continue apace. The emergence of robo-advisors gives a good launching point for investors just getting started. However, we don’t know when – or if – a so-called robo-advisor might ever be able to compete with the expertise and caliber of personal service that SageVest advisors offer our clients. Technology still remains rudimentary for both investment management and financial planning, so choose carefully, depending upon the complexity of your finances.

Tip: Make use of current financial technology to facilitate basic financial tasks like bill pay, managing cash flow, automating savings, etc. However, be cognizant of their limitations. For more complex finances, work with an independent advisor – one with the human touch, who can understand all the nuances that make up your personal wealth landscape.

SageVest Wealth Management works with individuals, families, business owners, and others who seek ongoing, cohesive, customized wealth management services. For more information, check out who we are, then contact us to learn more.

References

[1] http://www.pewresearch.org/fact-tank/2018/04/03/millennials-approach-baby-boomers-as-largest-generation-in-u-s-electorate/

[2] https://www.ssa.gov/news/press/releases/2019/#4-2019-1

[3] http://www.nationalpartnership.org/research-library/workplace-fairness/fair-pay/americas-women-and-the-wage-gap.pdf

[4] https://nwlc.org/issue/minimum-wage/

[5] https://s3-us-west-1.amazonaws.com/adquiro-content-prod/documents/Infographic_UP-URL_2040x1180.pdf