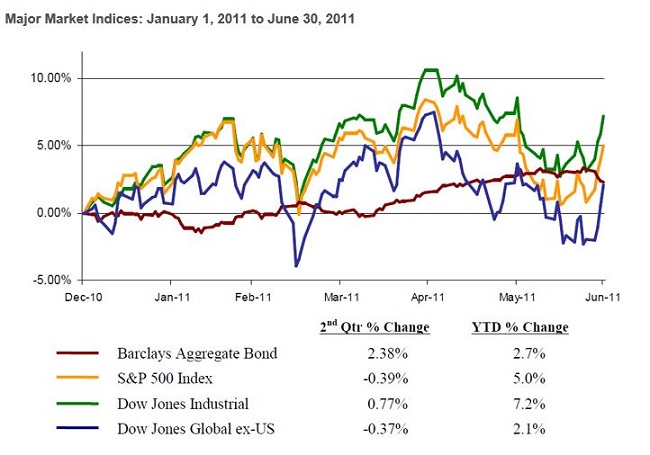

For the first time in four quarters, U.S. stocks did not advance. The S&P 500 lost 0.39% in second quarter as investors reacted to European debt concerns, the conclusion of the Fed’s quantitative easing program, high gas prices and indications that the recovery was stalling. Yet as June ended, encouraging domestic indicators and better headlines from overseas helped to renew the collective appetite for risk. Returns in the last week of June virtually erased losses that occurred during the quarter, allowing major equity indices to remain in positive territory for the year.

Domestic Economic Health

Our economy hit a “soft patch” this spring with mixed economic indicators. Manufacturing, durable goods orders and corporate spending remained strong, but consumer and retail figures entered slumps. Job growth – the largest ongoing concern about this economic recovery – took a significant step backwards as virtually no jobs were created in the past two months. Anemic job growth sent the unemployment rate progressively higher to where it now stands at 9.2% (the highest since December 2010).

As we look forward, jobs and government debt take center stage for assessing continued recovery potential. We explore these economic challenges (including their interrelated nature), other more positive indicators and our thoughts moving forward in the following pages.

Government Debt

SageVest Wealth Management previously noted that government debt levels were our greatest concern going into 2011 and they have proven to be trouble spots both domestically and abroad. Governments throughout the US, Europe and Japan are facing the same difficult dilemma of needing economic recovery to expand (to support and grow tax revenues) while simultaneously needing to cut spending (which could thwart economic growth). It is impossible to quantify how much government stimulus spending has actually benefited the economy, but it is quantifiable to assess that the amounts thus spent have not generated adequate results.

Countries such as Greece have reached the dire impasse where dramatic spending cuts were necessary to avoid immanent default. The $17 billion of loans they recently received required passage of a $40 Billion austerity bill comprised of tax increases and spending cuts that equate to 12% of the country’s GDP. It is difficult to imagine how a country can resume growth in the wake of such significant hardships to their citizens and their economy. While Greece is the most extreme example in Europe, they are not alone in their woes as Portugal, Ireland, Italy and Spain also face significant debt burdens, placing the future health of Europe and its financial systems at risk.

Fortunately, things are not as dire here in the U.S., but our debt levels are problematic and current spending is unsustainable. We officially reached our debt ceiling on May 16th and face an official debt ceiling deadline of August 2nd. There is general consensus that spending needs to be reduced, but a significant lack of consensus exists about how much, where and to what degree tax increases should be introduced.

As financial advisors, we understand the need to cut spending as our nation is currently spending about 50% more than the tax revenue it generates. If clients approached us spending $150,000 per year but only earning $100,000 per year, it would be difficult to advise them to only reduce spending by small incremental amounts. However, in the case of our national budget, we understand the negative ripple effects that swift cuts could bring to the economy. There is a delicate balance that must be achieved, and gradual, but effective shifts must occur.

We can only hope that the end result of current debt ceiling debates will lead to constructive results given the level of complicated and important decisions that now must be made in a rushed manner. It is fair to assume that budget cuts will emerge. From an investment standpoint, we are looking for efforts to retain spending on productive, growth initiatives. As we listen to CEO’s, there is a clear message that more jobs are moving overseas in pursuit of talent versus prior pursuits to find cheap labor. Shovel-ready jobs created temporary employment, but it is time to focus on education, research and development which will create sustainable job growth.

SageVest Wealth Management is also looking for longer-term clarity as we clearly hear CEO’s, our clients and others express hesitancy to make decisions in an uncertain government, tax and regulatory environment. For example, the bulk of our tax system is again set to expire next year. Uncertainty impedes decision making, including decisions to hire new employees. These are decisions that we can no longer place at risk.

As government focus shifts from stimulus spending to budget cutting, a sustainable recovery is being called into question. At this juncture in the recovery, job creation is a key litmus test of continued success.

Thankfully, Some Positive News!

It is important to take note of a number of positive indicators that are somewhat overlooked given the wave of negative headlines.

- Housing is showing signs of bottoming and possible recovery.

- Recent manufacturing numbers from auto makers, the Chicago Purchasing Manufacturer’s Index and the Institute for Supply Management Manufacturing Survey all posted better than expected results.

- Abroad, Japan’s recovery is underway and their industrial production has reached a 50-year high.

- Gasoline prices are declining both because of natural market movements and the International Energy Agency’s decision to release oil from reserves. Lower prices reduce cost pressure to businesses, consumers and the broad economy.

- Business loans are increasing and rates remain incredibly low.

- The Fed’s second round of quantitative easing (QE2) came to an end without any ‘hick-ups’ to rates or the economy.

- Corporate earnings and balance sheets remain strong; and, American corporations continue to hold over $2 Trillion in cash on their balance sheets.

Looking Forward

As we look forward, we recognize the weight that government debt burdens and the equal weight that reduced government spending bring to the economy. Our sense is that the risk of a U.S. government debt default is relatively unlikely (or at least would be short lived).

European debt concerns give us greater pause given the number of countries involved and the impact debt problems could bring to the European financial system. We have been maintaining lighter than normal international exposure for the past year, and have reduced positions with heavier financial allocations. The one area where we have been increasing international composition is within bonds. We feel that international bonds offer interesting potential as greater yields exist outside of the U.S. and currency offers an additional layer of investment opportunity. It should be noted that our international bond exposure now includes a greater amount of corporate bonds (not just government bonds) and that investment directives are steering clear of problematic European debt (as even current double digit yields are not deemed worth the risk).

SageVest Wealth Management does not want to overreact to concerns that could soon be alleviated, particularly here in the U.S., while an economic recovery still shows signs of life. On the same token, we will take further actions if we feel they are warranted. And, as always, we invite you to contact us to discuss these thoughts and your investments in greater detail.

If you found this article interesting, please SUBSCRIBE.