SageVest Wealth Management recently released our quarterly commentary. Highlights are as follows:

– Following steep declines, stocks rebounded and left investors fairly flat for the first quarter.

– Recent reports show signs of economic growth here and abroad, a positive indicator looking forward.

– After seven years, the efficacy of central bank actions, which have supported market rallies, is being drawn into question.

The first quarter of the year was an investment roller coaster. Broad U.S. stock markets tumbled more than 10% into correction territory, and selected international markets fell by more than 20% into bear market territory. Investor concerns centered around uncertainty about looming Fed interest rate hikes, implications of collapsed energy and commodity prices, and low economic growth forecasts around the world that might unleash a global economic recession.

Yet, despite these walls of worries, stocks managed a strong bounce back, leaving the markets fairly flat as of the end of the quarter. Stocks regained momentum as the price of oil moved higher, central banks unleashed more aggressive actions, the Fed held firm with interest rates, and job reports came in strong.

The Real Good News – The Economy

Economic stabilization and improvement is certainly good news. What’s better is that signs of improvement abound. Labor markets are strengthening, notably in the US and Europe. Global manufacturing is on the uptick, with important improvements in Europe and China. European bank lending is expanding, as are Europe’s GDP forecasts. This is all good news. These reports and others show signs of fundamental growth – growth that is real and proven, and that can lead to further opportunities on the horizon.

The Projected Good News – GDP Growth Forecasts

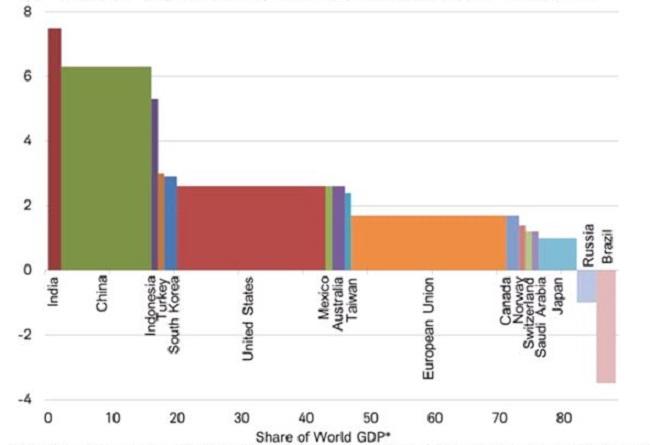

If we look at the IMF’s economic forecasts, they too predict an uptick in global growth, aligning with first quarter economic updates. Total world economic output is expected to increase by 3.4% in 2016, compared to a 3.1% global increase in 2015. While this is good news, growth among advanced economies (namely the United States, Europe and Japan) is expected to be more muted, with a forecast of 2.1% growth in 2016. An overview of the IMF’s economic growth forecasts is shown below.

As the chart depicts, despite improvements, global growth remains weak with the majority of countries well under 3% growth. This sluggish growth has been the catalyst for continued aggressive central bank actions, which we discuss next.

IMF 2016 GDP growth forecast and share of global GDP by country

* Countries presented sum to 88.4% of world GDP, those that each make up less than 0.7% of world GDP are not displayed.

Source: Charles Schwab, International Monetary Fund, data as of 1/23/2016.

The Tentative News – Seven Years of Central Bank Actions

Muted growth prospects of less than 3% GDP for most of the world have left global leaders puzzled and concerned. The world is still trying to ignite economic growth engines more than seven years after the depths of the Great Recession. This is despite years of accommodative central bank policies, with trillions of dollars being pumped into world economies. In theory, we should be seeing stronger growth by now.

Continued global weakness has led central banks to become increasingly aggressive, deploying a number of rather unconventional techniques. Most recently, these include negative interest rate policies, central bank purchases of corporate bonds, and outright government purchases of the stock market. To demonstrate the magnitude of some actions, the Wall Street Journal recently reported that the Bank of Japan owns nearly one third of the Japanese government bond market, and an astonishing 43% of Tokyo’s exchange-traded stock fund market[1]. Just imagine if the U.S. government began buying the S&P 500 index!

The good news is that, to date, just about every accommodative central bank announcement has been met with a rally in the markets. The cautionary news is that the rallies are becoming smaller and shorter. This is because after seven years without seeing stellar growth, the efficacy of central bank interventions is being drawn into question.

Central bank actions have almost certainly helped to buoy the stock markets, but growth within the real economy has been far more sluggish, and there are several reasons why:

- Low, zero and negative interest rate policies erode investment income for consumers. Low yields are posing significant income restrictions, particularly for retirees who are reliant upon investment income. Low investment income limits spending potential. It also encourages riskier investments in stocks.

- Negative interest rates also put financial pressure on banks as they are charged to hold money. This creates an extra layer of cost to banks, that play a critical role in sustaining a healthy economy.

- Furthermore, a primary intention of current rate policies is to encourage banks to lend money. Trying to force lending potentially encourages more risky loans. Perhaps we shouldn’t forget lessons learned from the all too recent subprime loan market …

- Speaking of borrowing, companies too are borrowing more. We’ve seen corporate debt levels skyrocket in recent years. Cheap money has encouraged stock buy-backs and mergers, which have stimulated the stock markets. Unfortunately, it’s also encouraged a redirection of corporate funds away from long-term investments (technology, infrastructure and human capital – what we need for real long-term growth) in favor of short-term gains.

- Finally, the duration of these policies, now several years in the running, is beginning to undermine confidence.

The Outlook & Positioning

In the short-term, SageVest Wealth Management sees the potential for markets to move higher as the economy is improving (albeit slowly) and central banks continue to pull out all the stops. Looking to the mid-term and long-term horizon, we know that bull markets don’t last forever. We also have concerns about the ultimate effectiveness of central bank policies and the potential risk of central banks having too few tools left in their ‘tool belt’ if the economy stalls sooner than expected.

We don’t see this as a time to be greedy. We continue to encourage investors to ensure they have enough invested in stocks to be satisfied that you’re participating on the upside, as well as enough invested in cash and bonds to make sure you can get through a downturn, with latitude to buy more stocks.

As always, we encourage you to contact us with any questions about your investments or other financial considerations.

[1] WSJ, Central Banks Go to New Lengths to Boost Economies, 1/29/2016