One of the most frequent questions we receive from clients is “how much do I need to save for retirement?” The truth is, there is no one-size-fits-all answer to this question. Instead, we rely on specific personal factors to determine a path towards a prosperous retirement. To ensure smooth planning, it is helpful to understand the different means of saving for retirement and to have a general understanding of the dos and don’ts of retirement saving.

Where to Start?

There are several different savings vehicles and sometimes it is difficult to determine “what bucket to fill.” Below we discuss the different types of accounts an individual can use for their savings.

Cash Accounts (Checking/Savings/CDs)

- Great for everyday expenses and an emergency fund.

- Can also be used for excess retirement savings or other goals.

Individual/Joint Brokerage Accounts

- Investment accounts that can be used for saving and investing either for near-term goals or long-term goals (retirement).

- Penalty-free availability of assets at any time, regardless of age.

401(k)/Other Qualified Plans

- Employer-sponsored plans geared specifically towards saving for retirement.

- Tax deferral of all income and capital gains on plan assets.

Traditional Plans

-

- Contributions help to reduce your current year taxable income but are fully taxable upon withdrawal later in life.

Roth Plans

-

- Contributions do not reduce your current year taxable income, but the account value is tax free later in life upon withdrawal.

IRAs

- Retirement-specific savings that can help you meet your savings targets.

- Annual contribution and income limits relative to contribution potential.

- Tax deferral of all income and capital gains on plan assets.

Traditional IRAs

-

- Contributions help to reduce your current year taxable income but are fully taxable upon withdrawal later in life.

Roth IRAs

-

- Contributions do not reduce your current year taxable income, but the account value is tax free later in life upon withdrawal.

Health Savings Accounts (HSAs)

- Tax deferred savings accounts for qualified medical expenses.

- Permissible with high deductible health insurance plans.

529 College Savings Plans

- Tax advantaged accounts to save for college expenses.

Tips to Hit Your Savings/ Retirement Goals

-

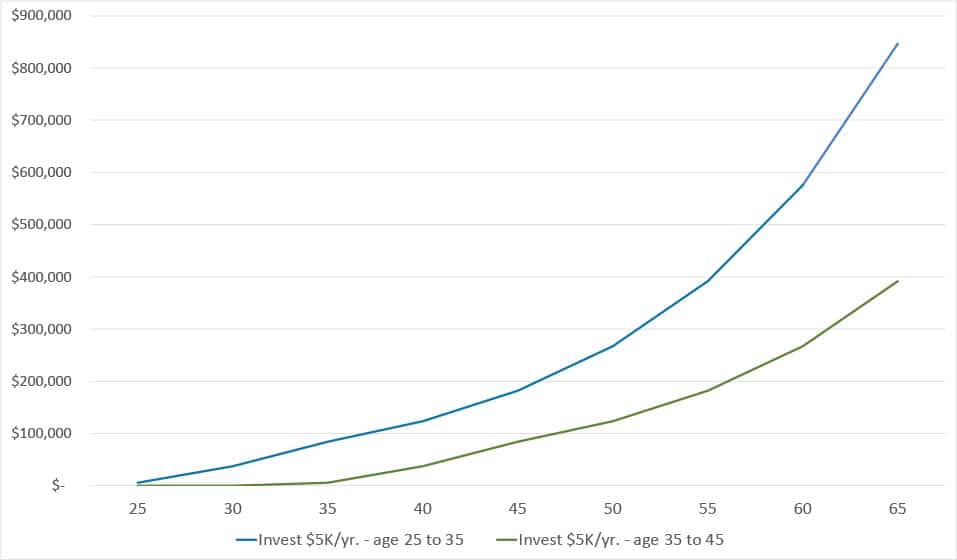

Start early

It is important to start early. If you have not begun your savings journey, it’s time to start. The power of starting early creates the possibility for your savings to have a longer time for growth.

-

Retirement plan savings are not enough

One of the biggest retirement savings misconceptions is to think you are done saving if you max out your retirement account such as your 401(k). While maxing out your retirement plan is a great and productive first step to take, most times it is not enough, especially for high-income earners. For younger savers, a savings target of 15% to 20% of gross income may be appropriate. Depending on how much you make, this may come out to greater than your 401(k) contribution limit.

Hence, capturing savings in addition to your 401(k) savings is often key to ensure a sound retirement.

-

Save in both non-retirement and retirement accounts

Should you save monies into a non-retirement account (i.e., an individual/joint brokerage account) or a retirement account (i.e., 401(k), IRA, Roth IRA)? The best answer is to save in both types of accounts.

Having monies in both buckets generally pays off in the long run. However, there are pros and cons to both types of savings. Below we list some important considerations.

Non-retirement account savings:

Pros:

- No contribution or distribution limitations.

- Only investment gains are taxable and at lower capital gain tax rates.

- Useful to help reach financial goals.

Cons:

- Fewer tax advantages.

- Capital gains taxes on investment trades.

- Taxable investment income.

Retirement account savings:

Pros:

- Possible tax benefit at contribution.

- Earnings grow tax-deferred or tax free.

- Useful to help reach financial goals.

Cons:

- Distribution rules.

- Contribution limitations.

- Taxes at distribution (unless Roth savings).

-

Automate savings

One great way to ensure you are capturing savings is by automating them as much as you can. Direct deposits into different accounts dedicated for savings can help you stick to your goals and targets.

-

Dollar cost averaging (DCA)

A practice of investing, dollar cost averaging (DCA) can be beneficial. Investing a fixed amount on a regular basis is a great way to develop a savings routine and help you meet your goals. DCA tends to be most beneficial in times of market volatility and unsettling investment prices. By investing on a set routine, you may avoid buying at market highs, while capturing lower market opportunities.

While saving for retirement is a marathon not a sprint, there are many steps to take to ensure you are on the right path. Among them, starting early and developing a sound savings routine can be very beneficial. Whether you are just starting to save or have been savings for years, we at SageVest Wealth Management want to help you meet your financial goals. Please contact us for more information.