If you’re like most people, you understand that a variety of Roth IRA and Roth 401(k) options exist and that they offer tax advantages. However, you might not understand which option is best for you, or if new lower tax rates make a Roth IRA worthy of consideration. To help you determine if a Roth makes sense as part of your wealth planning, SageVest Wealth Management provides an overview of Roth IRA and Roth 401(k) options.

How Is A Roth IRA Different?

A Roth IRA is similar to a traditional IRA, but the tax treatment is reversed. You contribute post-tax dollars, meaning that you can’t deduct the contribution on your tax return. However, contributions grow tax-free and future withdrawals are also tax-free.

Additionally, Roth IRAs are more flexible in terms of accessing your money before 59 ½, the age when traditional IRA withdrawals become penalty free. With a Roth IRA, you can access your original contributions at any time, both tax and penalty free. You just have to wait for your earnings to be held in the account for at least five years before earnings can be withdrawn.

Example: You’re 30 years old and have contributed $4,000 per year to your Roth IRA for the past four years ($16,000 in total). The account is now worth $25,000, with investment earnings. You’re about to buy a house and need money for a down payment. While you can’t access the $9,000 of earnings in your Roth IRA, you can access the $16,000 of contributions both tax- and penalty-free, to put towards your home purchase.

Roth IRAs And Tax Brackets

If you’re currently in a low income tax bracket, a Roth IRA could be a great saving option for retirement. You don’t get a tax deduction benefit now, as compared to making a traditional deductible IRA contribution. However, this saving might be minimal anyway, because you’re in a low tax bracket. It might be worth paying 10%, 12% or 22% in taxes now, for your contribution to be forever tax-free in a Roth IRA.

However, if you’re in a high tax bracket, or expect to be in a lower tax bracket when you retire, a Roth IRA might not make sense for you, versus the immediate tax relief provided by a traditional IRA.

Can I Contribute To A Roth IRA?

Income limits help to simplify the decision of whether or not to contribute to a Roth IRA. You’re only eligible to contribute to a Roth IRA if your Modified Adjusted Gross Income (MAGI) is less than state thresholds:

2019 Roth IRA Contribution Income Limits

| Filing Status | MAGI | Contribution Limit |

|---|---|---|

| Married | Less than $193,000 | $6,000 * |

| $193,000 - $202,999 | Phase out contribution limits appy | |

| $203,000 and above | Ineligible | |

| Single | Less than $122,000 | $6,000 * |

| $122,000 - $136,999 | Phase out contribution limits apply | |

| $137,000 and above | Ineligible | |

| * Individuals age 50 and older can contribute an additional $1,000 per year. | ||

If you earn too much to make a conventional Roth IRA contribution, you might consider a traditional or back-door Roth IRA conversion, or a Roth 401(k) if your employer offers this option.

Traditional Roth IRA Conversions

A traditional Roth IRA conversion occurs when you convert pre-tax dollars existing in an IRA to a Roth IRA, electing to pay taxes on the converted amount. This typically only makes sense if you expect to be in a higher tax bracket in retirement.

Example 1: You own a business that operated at a loss in the current year, and your total taxable income is negative. A Roth IRA conversion could be the silver lining to a bad income year, allowing you to convert taxable dollars to tax-free Roth IRA dollars while potentially paying nothing in taxes.

Example 2: Due to an employment gap this year, your income was $50,000, but will be $250,000 going forward. A Roth IRA conversion could be advantageous, assuming you have the resources to pay the associated tax liability.

Example 3: You currently earn $300,000 and expect your taxable income to be lower in retirement. A Roth IRA conversion might not make sense for you.

Back-Door Roth IRA Conversions

The above said, a back-door Roth IRA contribution could be of interest, regardless of your income, as it allows you to convert post-tax dollars. This happens when you make a non-deductible IRA contribution to a traditional IRA account, and then convert that contribution to a Roth IRA. Assuming you convert the same amount, you might not owe any taxes, as your original contribution was non-deductible.

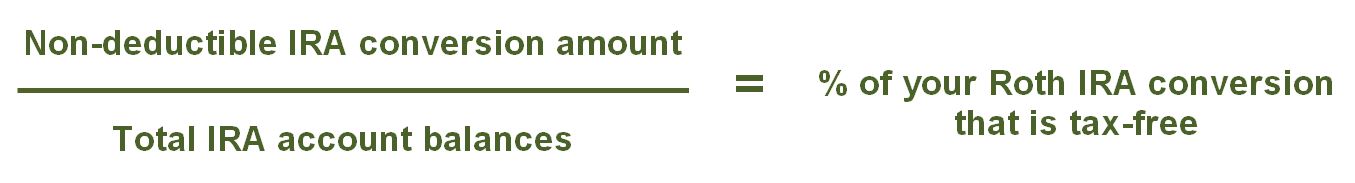

However, there’s a big caveat. The tax-free nature of a back-door Roth IRA conversion doesn’t hold true if you own other IRA assets. The tax equation for determining the taxable element of your non-deductible IRA to Roth IRA conversion is as follows:

If you own other IRA money that you’re not converting, this impacts your tax equation, making some of your Roth IRA conversion taxable.

Example 1: You make a $6,000 non-deductible IRA contribution, then convert the same dollar amount to a Roth IRA. Your IRA account balances total $100,000. Only 6% of your Roth IRA conversion is tax free, despite the fact that you made a $6,000 non-deductible contribution. The other 94%, ($5,640) is taxable, largely negating the benefits of pursuing a back-door conversion.

Example 2: You make a $6,000 non-deductible IRA contribution, then convert the same dollar amount to a Roth IRA. You have no other IRA account balances and all of your retirement assets reside in your employer 401(k) plan. In this case, 100% of your Roth IRA conversion is tax-free.

The Roth 401(k)

Perhaps the easiest way to channel monies into a Roth vehicle is through your employer retirement plan if a Roth option, such as a Roth 401(k), exists.

There are no earning limits like those associated with making a Roth IRA contribution. However, you should still consider carefully whether a Roth 401(k) contribution makes sense for you, versus a traditional tax-deductible 401(k) contribution. If you’re early in your career, or experiencing a low point in your earnings, a Roth 401(k) could be the best option. However, if you’re a high income earner, the traditional 401(k) may remain the best option, helping to reduce your current taxable income.

SageVest Wealth Management counsels client on all facets of their finances. This includes how to optimize your assets among different account types, and tax planning through various Roth-related strategies. Please contact us to explore Roth options that might be available and appropriate for you.