Jennifer Myers, CFP ® established SageVest Wealth Management in May 2007, to provide high quality, customized, and comprehensive investment management and financial planning services to individuals, families, and business owners in the Washington, DC area and beyond.

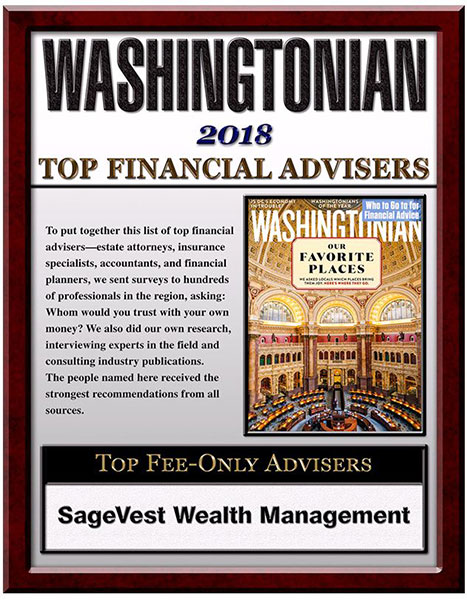

A decade later, and with twenty years of experience, Jennifer’s the recipient of multiple top advisor awards, including Washingtonian Top Financial Advisor, and SageVest Wealth Management is celebrating our tenth anniversary! This seems an ideal time to thank our clients, and to offer a quick reminder of our services, our fields of expertise, and the core principles that guide us in pursuit of your financial and life goals.

How We’re Different

Personal Wealth Management

We invest and manage your assets, and provide continuous financial planning services that are customized to your unique needs, in order to help you accomplish your financial objectives. You’re the guiding principle of our relationship with you.

Your Trusted Fiduciary

We have always, and will always, proudly serve a fiduciary role. This is a legal responsibility, meaning that we always place your best interests at the center of our recommendations.

CFP® Advisors

All of our advisors hold Certified Financial Planner (CFP ®) certifications, generally considered to be the highest professional standard.

Fee-Only Advisors

Fees are important, but they shouldn’t be complicated. Our fee schedule is simple, transparent and aligns our interests with yours. We receive no commissions or incentives.

New Technology

SageVest Wealth Management continuously evaluates and updates operations to adopt new technology that will simplify and improve our clients’ financial experience.

The Advisor-Client Fit

This is an essential aspect of a successful wealth management relationship. We take the time to get to know you.

Connecting You With Your Wealth

Ultimately, we believe that wealth management extends beyond simply knowing you well. It also requires an understanding of what matters most in your life. With this knowledge, we’re able to truly connect you and your loved ones with your wealth in the most meaningful ways.

Who We Serve

Individuals

Whether you’re single due to a life event like divorce or the death of a spouse, or because you simply value your independence, we can help you to secure your financial future.

Couples

SageVest Wealth Management works with new and established couples at all stages of life. We also pride ourselves on offering financial advice for same-sex couples.

Families

We focus on financial well-being for your whole family, including wealth discussions across multiple generations, and financial education for kids, through our website, SageVestKids, and via our financial workshops for young adults.

Women

As a woman-owned business, we understand the distinct financial challenges women face. For example, women typically live longer, yet may have fewer savings due to lower pay or time away from the workforce to fulfill parenting or care-taking roles. Our approach incorporates women’s financial education, guiding you towards wiser decision-making that supports a stronger and more confident future.

Retirees

We work with you to develop a customized plan and reevaluate it with you regularly. This ensures that financial and retirement priorities are always aligned. Considerations include when to apply for Social Security, how to sign up for retirement benefits, pension payout options, and more.

Business Owners

Your financial planning is more complex as a business owner. Our CFP® credentialed planners incorporate both personal and business goals into your wealth planning

Federal Employees

SageVest Wealth Management is based in the DC Metro area. We have experience working with Federal, State and local Government employees, World Bank employees, and military members.

How We Help

Investment Management Services

As fiduciary advisors, we assume the due diligence and active monitoring responsibilities, blending passive and active investment styles, and always placing your best interests first.

Retirement Planning Specialists

We help you to create a roadmap for retirement success, including examining a number of ‘what-if’ scenarios, to help you enjoy a rewarding and healthy retirement lifestyle.

Tax Optimization Strategies

Our CFP® advisors engage in proactive tax planning, identifying planning opportunities to help you maximize your after-tax potential and save money on your taxes.

Saving For College

Educational funding is a fast-growing expense for families. We can help evaluate your college funding options, so that you make smart decisions about saving for college.

Insurance Coverage Needs And Beyond

Our asset protection assessment extends beyond your insurance needs. We include asset titling, legal structures, and more, to help safeguard what you’ve accumulated.

Legacy And Estate Planning

Your wealth provides opportunities for you and your loved ones, during your lifetime and beyond. Our CFP ® advisors guide your legacy planning with compassion and experience.

Business Planning

A number of our clients run consultancy or small business practices. We actively support both your personal and business wealth objectives, creating distinct, yet mutually supportive business and personal strategies.

Life Transition Counseling

Life can bring both anticipated expenses like buying a house or wedding costs, and unexpected financial challenges like divorce, disability, or sudden loss. We help guide you through life’s significant events with understanding, respect, and a strong financial plan.

While SageVest has changed over the last ten years, adapting to market fluctuations, new technology, and expanding client needs, our core principles have remained steadfast. We enjoy working with a wonderful group of clients, who bring pleasure and fulfillment to our working lives, and we look forward to continuing our contribution to your financial fulfillment and wealth success in the years to come.

If you’re looking for a fee-only, independent financial advisor with integrity, experience, and technical ability, please contact us to learn how we can help you achieve your own personal wealth future.