The current political landscape has federal employees, contractors, and many others facing job uncertainty or loss. If you are in this situation, now is the time to assess your financial health. In addition to initiating an active job search, here are strategic steps to consider to help protect your finances.

Assets and Debts

Take an inventory of all of your assets: home, car, savings, investment and retirement accounts. Do the same for your necessary expenses including mortgage, car, and loan payments; utilities, grocery bills and insurance premiums.

Emergency Savings

An emergency fund ideally covers 6 months of expenses and gives you a cushion if you lose your job or have a large expense. If you can’t cover 6-12 months in necessary expenses, you should make it a priority to boost cash savings.

How to Capture More Emergency Savings:

- Cut your discretionary expenses (i.e., dining out, entertainment, travel, and shopping) to free up cashflow for savings.

- Possibly pause savings into other accounts such as your 401(k), TSP, IRA, or 529 college savings accounts. However, if you choose to do so, it is essential to revisit and resume savings when possible to avoid falling behind on your savings goals.

- Temporarily stop charitable giving.

- Redirect elective debt pre-payments such as extra payments on your mortgage to emergency savings.

- If you might need to borrow money to sustain your finances, consider applying for a home equity line of credit (HELOC) while you have the income to qualify. No money should be drawn on the line of credit unless absolutely needed.

Don’t:

- Don’t commit to any large expenses.

- Don’t electively take on new debts unless absolutely necessary.

- Don’t take a loan on your employer retirement plan if you’ll be required to repay the loan or have it reported as taxable income upon losing your job.

Unemployment

If you lose your job, you can apply for unemployment benefits. Such benefits help to buffer lost earnings, but the benefits are modest relative to your current income. Benefits typically last up to 26 weeks, but the duration varies by state.

If you are self-employed, you should be prepared for the fact that you might not qualify for unemployment benefits. Most states require that you pay into your state’s unemployment fund, typically for a number of quarters prior to filing for benefits.

Severance Pay

Severance pay is sometimes offered as part of an employment termination. This can dramatically improve your financial standing upon losing a job, depending upon the amount of the benefit. One important thing to remember if you do receive a severance is that it’s taxable.

Other Income Benefits

Determine if you will be eligible for pension or Social Security income. These sources of income can help offset lost earnings. However, commencing benefits early can reduce your long-term lifetime benefits and your long-term financial security. Starting Social Security benefits at age 62 reduces your benefit by approximately 30% versus waiting until your full-retirement age, and by approximately 77% versus waiting until age 70.

Health Care Insurance

Health insurance can be expensive, possibly in excess of a thousand dollars per month depending upon your age and the number of family members insured. Employers often offer COBRA benefits, but you will likely be required to pay the premiums. Things to consider if you lose paid health care benefits include:

- Can you obtain health insurance from your spouse’s or parent’s employer plan? Loss of employment is a qualifying event to join another plan outside of open enrollment season.

- Can you obtain coverage that is less expensive than COBRA benefits (which is often the case)?

- What are your coverage options through the Health Insurance Marketplace?

Investment Considerations

Hopefully you won’t need to dip into your long-term savings. However, if this might be needed, there are several things to consider.

- Is your portfolio positioned to supplement your income if needed? Evaluate if you might need to become more conservative to avoid the risk of having to sell stocks at lower values in the event that the markets decline from current levels.

- Furthermore, examine how you’re positioned among your accounts, ensuring that you have appropriate cash and bond holdings in the accounts best-suited to withdraw from if needed.

Taxes fall into these considerations:

-

- Individual, Joint and Revocable Trust Accounts

Tax liabilities for withdrawals are limited to capital gains realized if you sell investments. Reviewing your unrealized gains and losses helps to determine what tax impacts you could be facing. Note: You can use losses from investment sales and carryforward losses from prior tax years to offset any realized capital gains.

-

- Roth IRA Accounts

Withdrawals from your Roth accounts might be tax-free if you are age 59 ½ or older, if you have held the Roth IRA for at least 5 years, and/or if withdrawals are used for qualified exceptions such as paying for health insurance if you are unemployed.

-

- Traditional Tax-Deferred Retirement Accounts (i.e., 401(k), TSP, 403(b) and IRA accounts)

Withdrawals from traditional tax-deferred accounts are fully taxable as ordinary income, subject to Federal and state taxes. You might also incur a 10% penalty if you take withdrawals before age 59 ½ unless you qualify for an exception. Hence, withdrawals from these accounts are often recommended only as a last resort.

Evaluate Your Potential Future Earnings

Hopefully you will be able to replace or increase your earnings upon obtaining new employment. However, it’s important to evaluate the likelihood of doing so, particularly if you are facing the loss of your job at a time when many others in your field are also seeking employment. If you are concerned about the level of your future earnings, any decline in income should be factored into the decisions above.

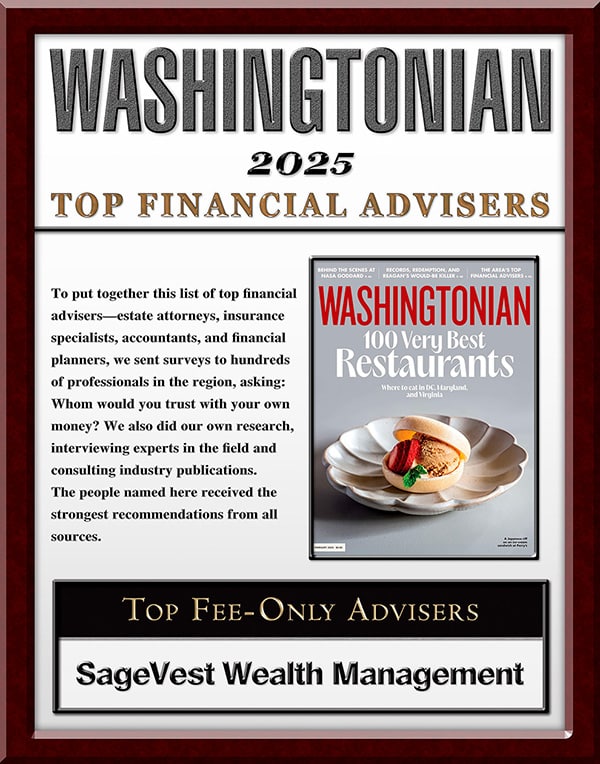

SageVest Wealth Management helps clients through many life-changing events, including job transitions. Our experience of working with private sector employees, Federal and public service employees, members of the military, and business owners provides the breadth of knowledge you need to evaluate your current finances and new opportunities you might pursue. We invite you to contact us for more information.