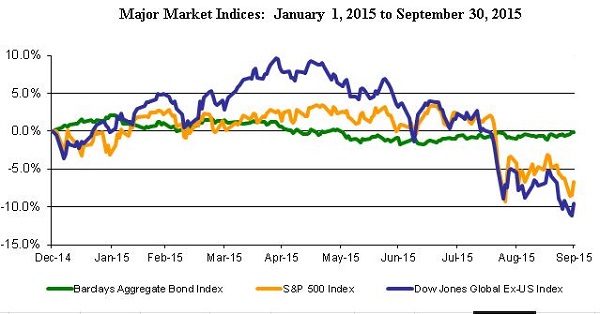

The third quarter was hopefully a time of enjoyable vacations, but it was also a time of tumult in the markets.

Performance among stocks was ugly, bringing the first correction since the autumn of 2011. Broad US stock markets were down 7% to 9% for the quarter and international stocks ended down more than 12%.

The only asset class that was positive was bonds.

| Major Indices | 3rd Quarter % Change |

| Dow Jones Industrial Average | – 7.6% |

| S&P 500 Index | – 6.9% |

| S&P 400 Mid Cap Index | – 8.5% |

| S&P 600 Small Cap Index | – 9.3% |

| MSCI All Country World Index, ex-US | – 12.2% |

| Barclays Aggregate Bond Index | + 1.23% |

As SageVest Wealth Management anticipated in early July, popular headline risks about a potential Greek exit were the least of investor concerns. Our primary attention focused on China, where events certainly deteriorated as the quarter progressed. Precipitous declines in China’s economy and their financial markets, coupled with falling global commodity prices cast questions about the outlook for global growth. Expectations of a US Federal Reserve Board interest rate increase and declining earnings reports among US companies also weighed on the markets.

Beyond these fundamental concerns, the return of sheer volatility had an impact. The Dow Jones Industrial Average gyrated more than 200 points on more than half of the quarter’s trading days, including a whopper 1,089 point swing on August 24th.

Time For A Healthy Perspective

As we look forward, we think it’s important to highlight a number of positive factors that could easily be forgotten after such a harsh quarter. Our US economy is continuing to grow, as evidenced by consumer spending, loan originations, new housing starts, auto sales and more. These growth indicators are encouraging. Additionally, monetary policies around the world remain incredibly accommodative, with a direct objective of stimulating growth. We started to see signs of broader global growth improvement earlier in the year, and recent expanded efforts could easily put global growth back on track.

With that said, we reiterate our communications from early June, when we cautioned investors that it was time to carefully evaluate appropriate investment positioning at this stage of a lengthy bull market cycle.The markets could very well buoy higher, but bull markets never go forever. In our eyes, this is a time when proper positioning is essential to ensure you have the ability to weather a market downturn, both financially and psychologically.

While SageVest Wealth Management is more neutral than pessimistic in our outlook, we address some of the main market concerns in our following comments.

China: Build It And They Will Come. But Will They Spend?

China’s economy has been long fueled by an infrastructure revolution. Expansive projects ranging from urban development to highways and more have supported high single-digit to double-digit growth rates for years running. It’s time to see if the ‘build it and they will come’ mentality pays off. Now that the industrial and urban infrastructure is built, and they have come, the real question is will they spend? If we look at consumption based economies, such as the US, it is likely that Chinese growth rates will eventually decline. The real question is how quickly that transition will ensue in China?

Unfortunately, the third quarter revealed a number of pervasive cracks in China’s growth. Reports showed rapid and progressive declines in both exports and imports, which were down 5.5% and 13.8%, respectively in August on a year-over-year basis, demonstrating weakness in China’s domestic economy as well as the global economy as a whole.

Beyond China’s economy, its stock market continued a tumultuous downturn throughout most of the quarter. Government officials attempted a slew of interventions; so many that they almost became comical – except for the volatility that ensued. Most of the actions were ineffective until they took the rather aggressive actions of devaluing the currency and later, cutting interest rates and reserve requirements. Market declines have since plateaued as investors wait to see if such actions will reinvigorate the China growth engine.

Risks in China remain real. However, stimulative actions in China and around the globe could easily trigger a rebound. It’s a wait-and-see situation where no one has the crystal ball, particularly when it comes to a country that is less than transparent. We have very little direct investment exposure to China, but continue to monitor developments given their impact as the second largest world economy.

A Strong Dollar And A Possible Interest Rate Hike

Thankfully, our US markets are far more transparent. They have also been more resilient in recent months. However, our multinational companies are still struggling with the effects of a strong dollar, which makes our goods and services more expensive to sell abroad. In April, we noted we would be watching corporate profits on concerns that profits might contract because of the dollar, and they did. Earnings among S&P 500 companies declined by 0.5% in the second quarter, and analysts expect profit reports will fall another 4.5% for the third quarter, according to FactSet. Declining earnings are never good, but the fact that the value of the dollar has temporarily stabilized is at least a step in the right direction.

As we look forward, several factors could impact the dollar, but two items are of note. First, is the current environment of currency manipulation. Currency wars certainly increase market volatility. They are also often the most difficult to predict. Second is the potential for the Federal Reserve to increase the federal funds rate. Higher rates in the US would attract money flows, which might push the dollar even higher, to the further detriment of US multinational companies. We believe the Fed is carefully monitoring this risk to US stocks and to the US economy.

Interestingly, most of the discussion about a possible rate increase has focused on bonds (due to the fact that interest rates and bond values generally move in an inverse direction). We’re hard pressed to see a significant increase in rates on the horizon but remain cognizant of a potential impact on bonds, and are positioned to help limit risks. Our concerns weigh slightly more toward US stocks than bonds.

We remain watchful for a possible Fed move. They could increase rates at any time, but we foresee any actions to be modest and gradual, if not a once-and-done move. While a rate move might have some impact, unless the moves are sequential, we see any effects as generally short-lived and hopefully fairly modest among both stocks and bonds.

In Summary

The third quarter reminded investors that the markets inevitably move in two directions. That’s not to say that what goes up must come down. The markets on a whole have always moved forward, just with retrenchments along the way.

Given where we are in a market cycle, this is an important time to make sure you have the right investments to prosper if things improve, to protect if they don’t, and to buy if they get worse.

As always, we encourage you to contact us with any questions about your investments or other financial considerations.

If you found this article insightful, please SUBSCRIBE.