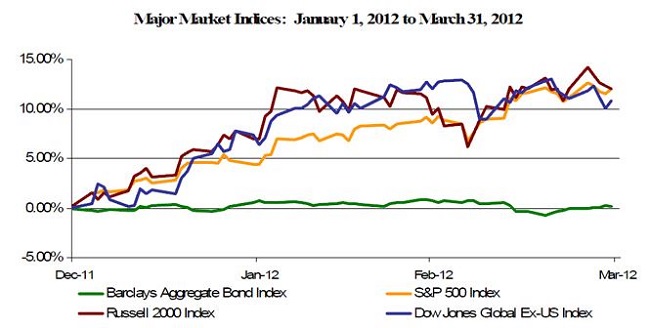

Spring arrived early in 2012 with a remarkable surge among world stock markets. In fact, it was the best first quarter for the U.S. stock market since 1998. Bonds on the other hand, posted stagnant returns as interest rates inched higher. The resurgence in equities reflects a sharp change in investor sentiment and regained confidence that the economy might not fall into the dire state that people began to expect throughout 2011. The reality is that many of the significant challenges of 2011 persist today; however, monetary actions in Europe have likely averted the most worrisome of outcomes.

Just The Beginning?

After a quarter that produced returns respectable of an entire year, a logical question is whether the markets can continue to move even higher? If we look to the past two years, the first quarter brought positive returns that quickly evaporated as we moved into summer. Each of these pullbacks was instigated by the European debt crisis. While Europe’s debt problems are anything but solved, we can fortunately say that recent monetary infusions by the European Central Bank (ECB) offer the greatest hope for Europe we have seen in years. The ECB’s Long Term Refinancing Oa REMAperation released $1.33 trillion of cheap three-year loans, giving European banks the liquidity they needed to avert a collapse of the banking system. A successful Greek debt restructuring also rendered renewed optimism throughout Europe.

If we assume that the worst is behind us in Europe (at least for the time being), and if we continue to achieve growth in our domestic economy, we could easily see a continued upward trajectory in stock prices. Much of the first quarter’s performance simply erased the effects of potential overselling during the height of the debt crisis. Domestically, our stock markets are higher than prior to the sell-off, but global stock markets still have not reached parity with earlier 2011 highs. As a cautionary note, even the most bullish investors should evaluate expectations, as a continuation of the first quarter’s gangbuster performance is fairly unlikely. Furthermore, as recent years have taught us, unforeseen events can always unfold and disparage even the best predictions.

Ready, Set, Go!

Liquidity infusions by the ECB in December and again in March are akin to actions that the Federal Reserve Board (Fed) has implemented on multiple occasions here in our domestic economy since the downturn. On a positive note, these monetary actions have added a bounce to the investment markets and the economy upon virtually each release. There is no doubt that cheap government money infused into the economy has yielded results, particularly in our domestic markets which have received the greatest level of government and monetary stimulus. Our employment market has been modestly improving. Overall GDP growth has been positive. Manufacturing activity has increased handsomely, even within the beleaguered auto industry. Furthermore, business and consumer confidence, as well as actual spending, are encouraging. These are all signs of growth and progress in the right direction.

Analogous monetary actions in Europe are now hoped to render similar results, particularly among struggling Southern European nations. Europe is widely believed to have already entered a recession as their economies were hard hit by the 2011 European debt crisis combined with continued government spending cuts and higher taxes. Unemployment levels are of real concern. Unemployment across the Euro area is over 10% and more astonishingly over 20% in Spain and Greece. Needless to say, recovery is much needed. ECB actions have allowed the world to take a collective sigh of relief. Investment

money is beginning to return to Europe and the prospect of a brighter future is once again within the realm of reason. We are now waiting (and hoping) to see positive results emerge, as they have in the U.S. Encouraging initial signs include a return of capital to the Euro zone and an uptick in bank lending.

But Can We Go (Grow) Fast Enough?

The world economy is regaining a healthier outlook, with a decent prognosis of continued growth. That said, the question that we have been asking for quite some time remains. “Will growth occur fast enough to support a necessary future unwinding of government and monetary actions?” Recent comments by Federal Reserve Chairman, Ben Bernanke, clearly reflect concern that growth has not been as rapid as the Fed might have expected, or what the economy needs. Unemployment remains persistently high (albeit better), and the housing market remains extremely weak. On the bright side, alleviated concerns about Europe could reinvigorate world growth both here and around the globe.

We began to see a resurgence in our domestic economy in the 4th quarter, and similar growth is expected to be reported for the 1st quarter. While our domestic GDP clocked in a mediocre 1.7% real rate of growth in 2011, it ended the year with a growth spurt that equated to an annualized rate of 3%.

With these updates, we can answer the question above. Economic growth is improving, but it needs to be stronger. Three percent GDP growth is close to the minimum required to unwind government and monetary actions. To put things in perspective, the Fed has infused more than $2 Trillion into our economy since 2008. This equates to more than 13% of GDP (translation, more than 13% of our annual economy). Such a large ‘investment’ requires significant returns in order to ‘repay’ or successfully

‘unwind’ the investment. Now, more than 3 years into the process, more handsome returns were expected to materialize more quickly.

With the Olympics coming up, an analogy could be the support that a corporate sponsor provides to an Olympic runner, particularly if it centers its marketing campaign around the athlete. At this point, the sponsor has provided all of the training support that the runner needs, and is now out on the field saying, “Come on, you can do, you can do it!” The Fed has similarly provided incredible support and is now cheering to the economy, “Come on, you can do it, you can do it!” At the end of the day, both the sponsor and the Fed can only provide support, resources and encouragement. They can’t guarantee results.

Fortunately, there’s still time before the Olympics and time for the economy to continue on a growth path. It’s just time to kick things into high gear. Perhaps this can happen with new liquidity flowing through Europe, continued support here in the US, and continued economic expansion around the world.

Looking Forward

Barring any ‘hiccups’, the environment is relatively strong to support continued growth as we look toward the balance of 2012, although almost certainly at a slower pace in terms of stock market growth. As with any year, there will inevitably be some twists and turns. These could include items that are already on the radar screen or others that could be unanticipated. Here’s a quick look at some of the ‘hot topics’ as we see them.

European Debt

Both Italy and Spain have billions of dollars of bonds that have to be sold this year. If investor appetite for risk remains strong, these bonds should sell without any problems. However, if growing concerns about Spain’s economy begin to worry investors, bond auctions could experience difficulties, possibly prompting additional European support. We expect that support would be forthcoming, but a return of European debt crisis headlines could easily spook the markets.

Iran & Oil Prices

The Iran situation is likely one of the least predictable, and potentially volatile. Diplomacy efforts and upcoming stringent sanctions could help to resolve the conflict, but the outlook for oil prices has been widely debated. If we look at raw fundamentals, there is a strong probability that oil prices will fall based upon higher than normal crude stockpiles (excess inventory) and Saudi Arabia’s stated commitment to support demand. That said, oil prices, like other commodities, are heavily traded based on investor psychology and could spike if the Iranian conflict is exacerbated.

China’s Declining Growth

China recently lowered its growth target for the first time in 8 years, now projecting growth of 7.5% in 2012. The world has been expecting growth deceleration for a while, begging the question “Will China experience a soft or hard landing?” It is too early to know for certain; however, our sentiment is that China will continue growing, albeit at a slower pace, experiencing a soft landing. Ironically, such an outcome could send positive reverberations throughout the broader world economy if economic output shifts to other countries.

Supreme Court’s Ruling On Health Care

The Supreme Court is expected to release its decision on the health-care overhaul in late June. Quite honestly, the markets could rejoice, regardless of the decision, just on the basis of finally gaining clarification. If the law is upheld, significant reform efforts are already underway and would continue. If the law is disbanded, businesses could expand hiring with reduced future health care cost expectations. The most disconcerting outcome would be a partial repeal of the law, leaving a health-care reform program that simply doesn’t work.

Taxes and Political Debates

Congress has been relatively quiet in recent months, but we will likely see renewed contentious debates later this year, as the bulk of our tax structure is about to expire on December 31st, rendering higher taxes across the board. If the past is any indicator of what is to come, all we can say is get ready…

Portfolio Positioning

To summarize the above, the most likely prognosis for the economy is continued growth, but the path we will follow can take twists and turns, and the adequacy of growth could begin to fall into question. SageVest Wealth Management is therefore positioning portfolios to participate in this joyous market upturn, while refraining from betting the farm in light of significant uncertainty. Our primary objectives remain the same – helping clients to grow their wealth and allowing them to enjoy a good night’s sleep. Please contact us for more information.

If you found this article interesting, please SUBSCRIBE.