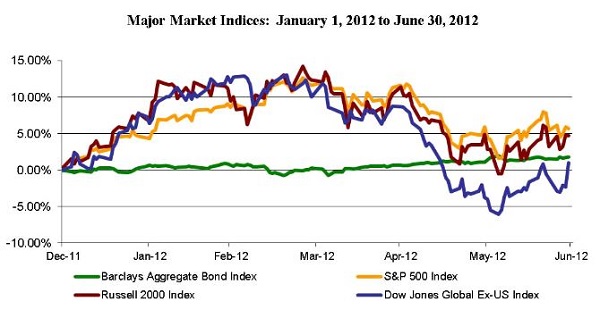

The opening quarter of 2012 was the finest quarter for U.S. stocks since the late 1990s; the second quarter was a markedly different story. After an all-but-flat April and an abysmal May, stocks finally managed to advance in June, much of which happened on the last trading day of the quarter when renewed hope emerged from Europe. The second quarter wasn’t as bad as it could have been, but institutional and individual investors contended with plenty of bumps in the road. These bumps reflect a continuing struggle to achieve recovery and growth against numerous headwinds.

The Second Quarter In Brief

World markets pulled back in the second quarter filled with major news items: the European Union’s struggle to bail out banks and governments while trying to stave off a Greek exit from the euro; uncertainty about the Supreme Court’s decision about the Affordable Care Act, which was largely upheld; the unsuccessful Facebook IPO; the largest California city bankruptcy; and, another apparent “soft patch” in the U.S. recovery. Perhaps the most important domestic news was the fading of job growth. The unemployment rate ticked up from 8.1% to 8.2% in May and remained at that level for June as payrolls posted much softer new jobs figures, creating the weakest quarter of job growth since the labor market began to recover in 2010. With lighter job growth and renewed economic concerns, consumers began spending less, despite declining gas prices.

The economic landscape faced large obstacles on the international front. At the start of the year, 12 European nations had slipped into recessions, including Great Britain, Spain, Italy, Ireland and the Netherlands. The quarter ended with Greece still in the euro, but with strong evidence of a global manufacturing slowdown, now drawing healthier economies into question.

May elections in France and Greece rendered political upsets. Germany lost a key ally when France’s Sarkozy lost to recently elected President Hollande. In Greece, parliamentary elections failed to result in a workable coalition government forcing special elections in June. The Syriza party that had threatened to reject the latest EU bailout failed to take power. Two more moderate parties were left to create a coalition, thereby reducing, but not eliminating, questions of a future Greek exit from the euro.

Other Eurozone economic problems worsened during the quarter. S&P cut Spain’s credit rating from A to BBB+ and downgraded 11 Spanish banks, which cued a rescue. The EU jobless rate hit a Euro-era high of 11.1% in June. The EU came up with a couple of bold ideas in June: it crafted a plan to recapitalize troubled banks with liquidity injections from the Eurozone rescue fund (without adding to existing sovereign debt), and it proposed a single Eurozone banking regulator.

With dips in consumer demand around the world, key manufacturing economies entered declines. By the end of the quarter, the economies of the U.S., China, Japan, Germany, Great Britain, Italy, France, South Korea and Taiwan all shared something in common: manufacturing sector contraction. Even the coveted Chinese economy has experienced a slowdown where this year’s growth in GDP is expected to decline to 8%, after three decades of 10% average annual growth.

Progress In Europe

Once again, potential crisis events prompted action in Europe, allowing the quarter to end with hopes of an inflection point in the European debt crisis. Euro-zone leaders announced a significant step toward closer integration of the currency bloc by creating a single supervisor to oversee banks in the 17 nations that use the euro currency. They also announced shorter-term measures to help Spain and Italy to achieve more sustainable borrowing costs.

The objective to bring European banks under a singular banking system is the most substantial effort thus far toward true financial unification, which we firmly believe is ultimately required for the survival of the euro. It is also the first sign that Germany is willing to partake in financial unification efforts, perhaps more noteworthy than the actual details of the deal. These are all positive signals. That said, the ink of this deal is far from dry. Final plans to create a unified system are hoped to be released before year-end, and there will surely be obstacles along the way. These include determining the supervising body, the role that body will serve and what authority the body will have to impose requirements. We expect heated discussions throughout this process as new financial requirements are sure to emerge. Nonetheless, this announcement represents progress and gives hope that Germany could be willing to agree to greater financial integration in the future.

Year-End Contentions

Speaking of heated discussions through year-end, we are poised to experience many of those domestically. The presidential election process is kicking into full gear with plenty of hot topics, namely: the impending ‘fiscal cliff’, which will bring higher taxes along with dramatic budget cuts in 2013; the looming debt ceiling, which we are projected to reach by year-end and which could bring another nasty Congressional showdown; and, continued debate about health care reform.

Sadly, we have little hope of reaching accord on these topics in advance of the elections, or perhaps before year-end as our congressional leaders remain at decisive divides. For the time being, a continued ‘muddle through’ approach appears the most likely, presenting continued challenges to true growth momentum. On the flip side, this presidential election year could yield a pleasant surprise if history repeats itself. Over the 84-year history of the S&P 500, the stock market has posted positive returns over 80% of the time during the second half of presidential election years.

Central Bank Actions

One area where actions have been occurring, and with growing furor, is among world central banks. Recent economic weakness has prompted central banks in China, the euro zone and the U.K. to initiate actions in an attempt to stimulate growth. The Federal Reserve also recently announced plans to extend its “Operation Twist’ bond-buying program through year-end, and has referenced the possibility of additional measures if the U.S. economy wanes. While central bank actions have sparked market recoveries in the past, recent efforts have proven less fruitful. Bottom line, the staying power of monetary stimulus is falling into question because true economic recovery has yet to materialize at the anticipated and needed magnitude.

In our last newsletter, we raised the question: “Will growth occur fast enough to support a necessary future unwinding of government and monetary actions?” What we are seeing now is that concerns about government debt levels, extended economic weakness and persistently high unemployment are raising questions about the cause and effect relationship between monetary easing and economic growth.

Looking Forward

It’s difficult to paint a rosy picture after a recap of the second quarter. However, we remind individuals that Europe, a key linchpin to the world economy, is finally taking more aggressive steps to pave a road forward. We also remind investors that market timing (trying to be too conservative or too aggressive) can be just as, if not more, dangerous than maintaining investment discipline with risk-adjusted measures.

One of the few things that is certain in the world economy is that risk levels are elevated. When risks are high, outcomes can be significant to both the downside and the upside. If new efforts in Europe prove successful, they could spark a dramatic world recovery. Conversely, continued deferral to make decisions until risks reach critical levels could render very harmful results.

We remain cautiously invested, but nonetheless invested, among client portfolios. We believe this is a time to minimize risks with regard to investments intended to satisfy short and medium-term financial needs. However, we also are cognizant of the fact that most investors require long-term growth to achieve their longer-term needs, and that today’s ultra-low interest rates on bonds generally fall short of meeting those objectives. We want to ensure that our clients participate in market advancements, which can sometimes happen in short one-day market spurts, without incurring excess risk. Our portfolios remain diversified with a bias toward U.S. investments, but broadly invested both among and within bonds, stocks, hard assets and alternative investments.

As we look forward, we caution investors that the markets will likely remain volatile for a while. There are no silver bullets, but there can and eventually will be brighter days ahead. SageVest Wealth Management encourages you to contact us with your questions.

If you found this article interesting, please SUBSCRIBE.