The outlook for Social Security and Medicare are of growing importance for our economy.

The first baby boomers became eligible for Social Security in 2008 (at age 62) and for Medicare just last year. Costs of these programs currently represent approximately 8.7% of GDP and 56% of IRS tax receipts. By 2033, those figures are projected to climb to 12.5% of GDP and 81% of current tax receipts.

The following Barron’s reprint discusses a number of considerations, including how long-term impacts could affect your future benefits.

Individuals receive higher Social Security payments if they defer benefits. We encourage clients to consider higher benefit strategies (particularly if they are still working) but to also contemplate offsetting risks if qualification standards or tax treatment of benefits change over time. As always, please feel free to contact us if you have any questions about how these considerations might impact your current decisions.

Following is a reprint from Barron’s Cover Page Story, June 18, 2012.

Watch Out!

Unless Washington acts now, the costs of eldercare will drain the federal budget. Plus: How to manage your Social Security payout.

By: GENE EPSTEIN

For years, politicians and retirees could safely ignore the crisis facing America’s Social Security system. The problems lay in a distant, hazy future, far beyond the next Election Day and the next round of golf. That is now changing; the ground is starting to shake. The first of America’s 78 million baby boomers are turning 66, which means they’re eligible for full Social Security benefits. Last year, this same group began to qualify for Medicare, whose enrollment age is 65. A goodly number of boomers have been receiving reduced Social Security benefits since 2008, when the oldest turned 62. Nearly a third of all Americans turning 62 in 2010 opted for early Social Security.

In short, the future has arrived, and it doesn’t look pretty. The boomers in their 60s and the legions after them will put pressure on federal programs that support the elderly for years to come, according to projections by the nonpartisan Congressional Budget Office. The surge will fuel a process that eventually renders these programs too expensive to sustain. More ominously, the federal budget’s burden of eldercare will get heavier, not lighter, even after the boomers leave the scene completely.

More Out Than In …

Largely due to the reduction in Social Security payroll taxes paid by employees in 2011-12, Social Security incurred a $148 billion deficit in 2011 and is projected to have a $165 billion deficit in 2012. The payroll tax paid by employees has been reduced by 2% (from 6.2% to 4.2% of wages up to $110,100) in 2012 (Source: Social Security Trustees Report).

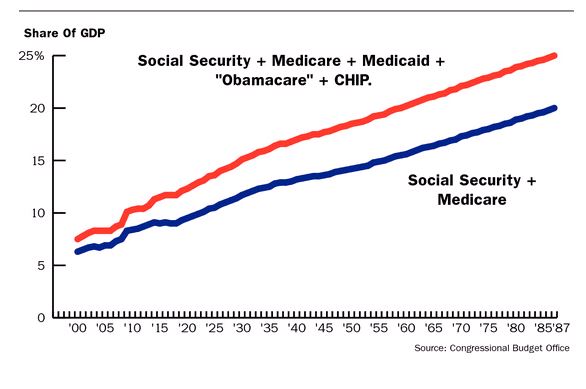

As the chart below illustrates, the costs of eldercare are rising faster than the growth of gross domestic product. The Social Security and Medicare parts alone, at 8.5% of GDP last year, will nearly double their share in 50 years, and keep rising from there. Add to Social Security and Medicare all other health-care entitlements, including Medicaid and “Obamacare,” and federal revenues as we know them get nearly swallowed up as soon as 2035.

Swallowing The Federal Budget

Total federal spending as a share of GDP has averaged 20.6% over the past 50 years, peaking at 25.2% in 2009. Eventually, at the rate they’re growing, the combined cost of Social Security and Medicare alone will gradually take over most of the Federal budget. Add in other programs, including Medicaid, and entitlements would swallow the entire budget.

Spending Our Money

Health care costs in America are equal to 16% of the US economy, a larger percentage than any other country in the world. The proportion of our economy that goes to health care is +43% greater than the country (France spends 11.2% of its economy) that holds 2nd place in this ranking (Source: Organization for Economic Cooperation and Development).

Unless, of course, radical steps are taken. There is no shortage of proposals to curb rising costs; for example, there is a plan to address Medicare and Medicaid put forward last November by House Budget Committee Chairman, Paul Ryan. Support for such proposals can only happen once taxpayers grasp the alarming dimensions of the problem.

One measure of what’s in store will be the dramatic shift in the “dependency ratio” – the ratio of those 65 and older to those 20 to 64. Since 1990, the dependency ratio has been relatively stable at five younger adults to every senior. It is due to fall to three-for-one by 2035, mainly because the seniors will surge in number.

Already, the system is showing strains. The Congressional Budget Office reports that costs of such programs have grown faster than anticipated since the recent recession, due to an increase in enrollees in response to the high unemployment rate.

Defenders of Social Security argue that its rising costs aren’t overwhelming, which is, strictly speaking, true. But Social Security is just one part of the federal government’s soaring costs of eldercare. Medicare and Medicaid, for example, were carved out of Social Security in 1965, lightening the program’s burden greatly as a result. To get a true picture of the problem you have to put those pieces back together again.

And if, say, the cost of providing food for retirees were suddenly put under a separate program? That would also lighten the burden of Social Security — but the result would be the same. However the federal government reshuffles the cost of eldercare across various agencies, new or old, the overall costs don’t change. Social Security contributes a few major line items to that cost, along with Medicare, Medicaid, and federal civilian and military pensions.

A related myth of Social Security is that it is supported by a huge trust fund valued at nearly $2.7 trillion at year-end 2011, money accumulated from surpluses generated by the system’s payroll taxes over the past few decades. But there is no trust fund in the sense that ordinary people use the term. All of the surplus money collected over the past few decades from Social Security payroll taxes has been spent to finance the operations of the federal government. Every time that cash was spent, however, IOUs were issued.

The result: funny money. When these Treasury bonds are redeemed to cover the liabilities of the Social Security system, the Treasury will have to pay up, since these bonds are Treasury liabilities. In a strict accounting sense, then, the bonds in the trust fund consist of memos-to-the-file, quite different from bonds normally put in a trust fund. The same objection applies to the Medicare trust funds, but with just $325 billion in assets, these get far less attention.

As the Congressional Budget Office has pointed out, “[T]he resources to redeem government bonds in the trust funds and thereby pay for benefits in some future year will have to be generated from taxes, other government income, or government borrowing in that year.”

The costs of eldercare can only be covered in those three ways. And those costs have to be contained. Because the projections are put in terms of programs, rather than in terms of separate costs for the elderly, we focus mainly on two programs, Social Security and Medicare, as stand-ins for the rest.

Most of the Americans covered by Social Security are retirees, but 30% aren’t. They include disabled workers and survivors of deceased workers. Similarly, 85% of Medicare’s beneficiaries are retirees, but several million non-elderly people, including the disabled, are covered under various aspects of the program.

Medicaid, a joint federal/state program, mostly covers the non-elderly. But a third of Medicaid’s spending is for long-term care, including home health-care and nursing-home services for the elderly. That’s a not-insignificant figure in a $262 billion program.

No matter how you do the projections, the costs of Social Security and Medicare are too high. The only question is how high, in fact, they will be.

The CBO releases two sets of projections, one based on the static assumption that all current laws will be unchanged, called the “baseline scenario.” The other set of projections, called “the alternative fiscal scenario,” seems more realistic. As the CBO explains, these projections are based on “maintaining what some analysts might consider ‘current policies’ as opposed to current laws.”

A key example of the distinction between current policies and current law that directly affects Medicare is payments to physicians. The law requires those payments to be cut 27% by 2013, so that cut has been incorporated into the baseline scenario. But cuts in payments have been included in the budget since 1997, and every year modifications have been made by Congress to prevent the reductions from taking place. Under the alternative fiscal scenario, then, the CBO assumes a continuation of policy: that the reductions will never happen.

What makes the CBO’s projections especially ominous is the conservative assumption regarding the growth of medical costs. For Medicare, the agency assumes a slowdown in what it calls “excess-cost growth” – the tendency for medical spending per person to grow faster than the growth rate of nominal GDP. If instead it simply extrapolated the rate of excess-cost growth from past numbers, Medicare’s share of GDP would be even more unmanageable.

For Social Security, there’s no difference in projections on the cost side between static and dynamic assumptions. Social Security costs will grow faster than nominal GDP through 2035, rising from a 5% share to 6.2% by 2033, as the number of people receiving benefits rises from 56 million to 97 million.

Spending will grow more slowly than GDP, with the share dipping to 6.1% by 2050, as the baby boomers die off. But the share will turn upward again, to 6.7% by 2087, as beneficiaries’ life spans continue to lengthen.

Medicare’s present costs as a share of nominal GDP, at 3.7%, are still lower than those of Social Security. But Medicare is projected to account for a much larger share over the long term. As with Social Security, costs will be driven by the larger population due to be served by the program. But even more important for Medicare is the assumed rate of excess-cost growth.

With those assumptions, Medicare’s costs as a share of GDP would rise slowly over the next 10 years, then accelerate, finally surpassing Social Security, at 6.3% of GDP, by 2033, with the gap then growing ever larger. But if the CBO simply extrapolated any of the rates of excess cost growth currently on record, Medicare’s share of GDP would be even more burdensome.

The cost of the two programs together will eventually swamp federal revenues, as those revenues stand. Nor will the pressure let up after the boomers really retire. By 2075, when the youngest surviving boomers will turn 111, federal outlays for Social Security and Medicare alone are projected to claim 18% of gross domestic product.

By contrast, federal revenues from all sources over the past 50 years have averaged 17.9% as a share of GDP and have never been higher than 2000’s 20.6%. Even that 20.6% would barely cover the cost of Social Security and Medicare by 2087, when the two programs together are projected to account for 20% of GDP.

It gets worse. Add the cost of three other entitlement programs for which the CBO also makes long-term projections: the federal costs of Medicaid, which provides the elderly with nursing and homecare; the federal costs of the Children’s Health Insurance Program, or CHIP, signed into law in 1997; and costs that will be mandated by the Patient Protection and Affordable Care Act, signed into law by President Obama on March 23, 2010.

These three additional programs taken together are projected to account for 3.6% of GDP by 2035, and 5% by 2087. Add that 5% to the 20% claimed by Social Security and Medicare, and you get 25%.

Over the past 50 years, total federal spending as a share of GDP has averaged 20.6%. At its peak, it ran 25.2%, in 2009. The CBO therefore projects that, by 2087, the combined cost of these entitlement programs, at 25%, will nearly swallow up the expenditure side of the federal budget at its recent peak.

Unless something is done. Regarding “changes to the Social Security and Medicare programs,” the CBO has declared, “sooner is better than enacting them later because future beneficiaries would have longer to prepare, because the revisions would be less drastic, and because the changes would enhance economic growth.”

As part of the “Ryan Plan” to curb the rising cost of Medicare and Medicaid, House Budget Director Paul Ryan has proposed that people newly eligible for Medicare be given a voucher instead. It would be used to purchase private insurance, and its value would increase at the rate of GDP growth plus 1%. The plan also proposes turning the federal contribution to Medicaid into annual block grants for the states, with the block grants also rising at the rate of GDP growth plus 1%.

That’s only a start, but we have to start somewhere and sooner is better than later. Put another way: Trend is not destiny because the trend can be changed. Are you listening, Mr. Obama and Mr. Romney?

How To Get The Biggest Payout

Like it or not, you may have reached the age where it’s time to crunch your Social Security numbers. Or you can let us do the work.

The main question is whether it’s better to take partial Social Security benefits at 62, wait to receive full benefits at 66 — or wait still longer to take even higher benefits at 70, the final age at which an application can be made. Here’s how the math works:

- If you’re 66, and you’re eligible for the top Social Security payments – $2,513 a month this year – your payments will be one-third higher than if you had taken benefits at 62.

- If you wait another four years, your monthly check would be a third higher again, or about $3,350 a month. (There are also scaled gradations between those ages.)

According to Rande Spiegelman, Vice President of Financial Planning at Charles Schwab, unless you suffer from bad health, and therefore doubt you’ll live very long, or suffer from unhealthy finances, and therefore need the cash, you should be biased in favor of taking benefits later rather than sooner.

The wild card, of course, is whether Social Security benefits get cut somewhere between now and the time you turn 70.

But assuming political stasis, the question isn’t so much Social Security’s lifespan but your own. If you live until 80, it will have paid to wait until you’re 66; and if you make it to 85, you’ll do better to take benefits at 70. These examples include an allowance for the riskfree interest that can be earned on dollars received early, though it isn’t a lot at the present low interest rates.

Granted, this isn’t a lot of money for Barron’s readers, but if you have been paying into Social Security all these years, why not maximize the payoff? And if you think the promised benefits soon will be reduced or vanish, you can start taking your payments right away.

Schwab’s Spiegelman rightly scoffs at the scare talk about huge cuts in benefits, but he agrees that two reductions might be sneaked in that could make a difference to people about to receive Social Security checks, or even to people currently receiving checks.

The first is some kind of means-testing, which would reduce benefits for higher-income seniors, a cut already introduced for Medicare. The Medicare Modernization Act of 2003, which established Medicare Part D covering prescription drugs, established a means-tested hike in premiums paid, mainly for doctors’ services. Beginning in 2007, higher-income seniors began paying higher premiums based on their previously filed tax returns.

The second reduction could take the form of a hike in the tax already imposed on Social Security. Right now, single people receiving at least $34,000, and married people receiving at least $44,000 or more—including dollars from tax-free bonds – pay taxes on 85% of Social Security benefits. That 85% could be raised to 100%. In addition, the income threshold at which the tax is imposed could be lowered, if only by the ravages of inflation.

Reprinted by permission of Barron’s, Copyright © 2012 Dow Jones & Company, Inc. All Rights Reserved Worldwide. License number 2933180033606. Dow Jones & Company’s permission to reproduce this article does not constitute or imply that Dow Jones sponsors or endorses any product, service, company, organization, security or specific investment.