- U.S. stocks started a sharp reversal in February on tariff concerns. Their descent accelerated post the quarter’s end when formal tariff rates were announced and imposed.

- International stocks rallied through March but also reversed course sharply at the start of April in response to tariffs.

- Bonds are mitigating risks as safe haven assets.

A Difficult Start to the Year for U.S. Stocks

Investment performance was mixed in the first quarter of 2025. Some sectors did well, but most U.S. stocks were a notable exception.

The S&P 500 index set an all-time high on February 19th. However, optimism shifted when President Trump announced his outlook and timing for tariffs. Investors quickly grew concerned about trade policy and the economy. The S&P 500 entered an official correction (measured by a 10% or greater decline) on March 13th. U.S. stocks have fallen precipitously further with steep declines shortly after formal tariffs were announced on April 2nd. The Nasdaq, known for its high-tech companies, entered a bear market (measured by a decline of 20% or more) on April 4th.

First-quarter investment returns (through March 31, 2025) are as follows:

Bloomberg U.S. Aggregate (U.S. bonds) 2.78%

S&P 500 Index (large U.S. stocks) -4.27%

Russell 2000 (small U.S. stocks) -9.48%

MSCI All Country World Index ex-US 5.23%

(International Stocks)

A New World Trade War

Free trade dominated world economics for decades with significant expansion since the 1990s after the end of the Cold War and with the creation of the North American Free Trade Agreement (NAFTA). This environment is now upended as we’ve entered a world trade war. President Trump announced 10% or higher tariffs on virtually every country on April 2nd. The most notable tariff rates on imported goods by country include 34% for China, 46% for Vietnam, 32% for Taiwan (excluding chips), and 20% on the European Union. Some countries are hitting back with retaliatory tariffs, such as China announcing a 34% tariff on U.S. exported goods, while others such as Taiwan are coming to the negotiation table.

Tariffs are taxes charged on imported goods. They benefit government tax revenues, but they also increase the cost of imported goods, possibly having a material inflationary effect. A large intention of the tariffs is to increase the level of manufacturing in the U.S. to benefit our economy and national security. While such an outcome could be ideal, it is not instantaneous due to the time required to shift or construct manufacturing facilities, should companies choose to do so. Furthermore, not all products could be produced here at their current prices.

Consumer Sentiment

Concerns about the effect tariffs might have on the economy and inflation have materially dampened consumer sentiment. After an upbeat second half of 2024, consumer sentiment took a sharp decline from a measure of 71.7 in January to 57.9 in mid-March.

We’ve already seen a pullback in discretionary spending in areas such as travel, clothing, and electronics. Several companies have already stated warnings of tepid earnings outlooks.

While there is an expectation that GDP growth is slowing, there are some bright spots. Thus far, year-over-year inflation (as measured by the CPI) has slowed from 3.0% in January to 2.8% in February. Additionally, unemployment has remained low as of the most recent reports (albeit not reflecting Federal job losses).

International Stocks

International stocks were the star performers in the first quarter after an extended period of underperformance. The MSCI All Country World Index ex-US ended the quarter up 5.23% as compared to S&P 500 declining by -4.27%. Several factors contributed to their outperformance including a weakening dollar that bolsters international investment performance.

While it was a great first quarter for international stocks, they also began sharp declines after the new tariffs were announced. Both U.S. and international stocks are feeling the global impact that trade wars can create.

Bonds Have Protected

Bond investments rose in the first quarter and have continued to reward investors during early April’s market volatility. After years of rising interest rates, bonds now offer more yield (interest payments). In addition to bonds offering higher yields, they have also gained in value as money has flooded out of stocks and into bonds for less risk.

It is difficult to forecast where rates are headed. The potential return of inflation could push interest rates higher. However, if the economy slows, the Fed could elect to lower rates to support economic growth. Currently, the markets are anticipating that the Fed will cut rates this year.

How Long Will a Downturn Last?

Every time the markets decline, investors naturally wonder how long it will last. President Trump has acknowledged that tariffs will have a financial impact, stating that there will be “short-term pain.” Realistically, no one can prognosticate how long a market downturn will persist.

Fears are high, as they are during all market downturns. The current extreme volatility could persist given the magnitude and breadth of global tariffs. However, things could turn around sooner, particularly if tariffs are modified or reversed. Negotiations with countries are the most likely path to such an outcome. There are reports that negotiations are starting with some countries, but not all. On a more extreme level, Congress could stop the tariffs. It’s currently unlikely that enough House Republicans would vote against Trump, but this could change depending upon the level of economic and investment impact in the coming weeks or months.

While past performance is not a guarantee of future results, it’s worth noting that the markets rebounded after tariffs were imposed on China in 2018. Stocks tumbled that year but flourished in the following three years.

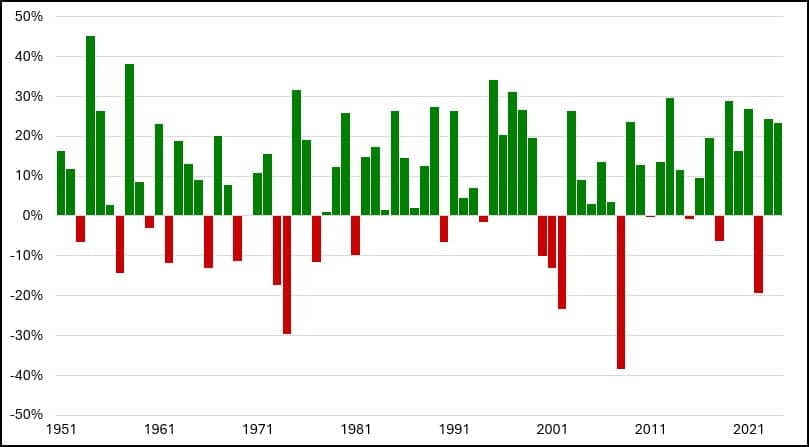

Looking back further, stocks have rewarded investors through many difficult times including inflation in the 70s, the dot-com bubble, September 11th, the Great Recession, Covid, and others. Since 1950, the S&P 500 index has posted negative returns in 20 out of 74 years. In all but two instances the index recovered after one year. The longest period of decline extended three years after the dot-com bubble. Despite this stretch, the S&P 500 gained more than 375% from January 1, 1999 to December 31, 2024.

S&P 500 Annual Returns 1951-2024

Getting Through a Market Downturn

Vast studies have proven that trying to time the markets is virtually impossible. It can be dangerous to sell during a market downturn, particularly given the statistics above. If you sell out of stocks, you need the courage to buy back when stocks are lower, but your fears might be higher. Otherwise, you lock in losses.

Steadying your nerves and taking a long-term focus has historically rewarded investors. Ideally, the depth of your income combined with cash and bond investments can cover your financial needs over an extended period. As our ongoing strategy, we always recommend such positioning for your security and comfort. We also believe in buying when stocks fall with the objective of enhancing your future wealth potential.

Working with You Closely

SageVest firmly believes that your investments should be based upon your individual finances. Our ongoing discussions, planning, and research overlay all investment decisions we make on your behalf. Please contact us with any questions you may have.